"Jake - Has Bad Luck So You Don't Have To" (murdersofa)

"Jake - Has Bad Luck So You Don't Have To" (murdersofa)

01/31/2019 at 15:39 ē Filed to: None

6

6

22

22

"Jake - Has Bad Luck So You Don't Have To" (murdersofa)

"Jake - Has Bad Luck So You Don't Have To" (murdersofa)

01/31/2019 at 15:39 ē Filed to: None |  6 6

|  22 22 |

Feels good man.

Party-vi

> Jake - Has Bad Luck So You Don't Have To

Party-vi

> Jake - Has Bad Luck So You Don't Have To

01/31/2019 at 15:52 |

|

Hell I gotta go through my Mint and update all my shit. I fear what it looks like ATM.

CarsofFortLangley - Oppo Forever

> Jake - Has Bad Luck So You Don't Have To

CarsofFortLangley - Oppo Forever

> Jake - Has Bad Luck So You Don't Have To

01/31/2019 at 15:53 |

|

Is that net income or savings vs debt?

UnderSTeerEnthusiast - Triumph Fanboy

> Jake - Has Bad Luck So You Don't Have To

UnderSTeerEnthusiast - Triumph Fanboy

> Jake - Has Bad Luck So You Don't Have To

01/31/2019 at 15:54 |

|

Do you use cards a lot or cash? One thing my girlfriend and I committed to not too long ago was not just making personal budgets, but actually getting them out in cash. For one example, normally we pay groceries under budget. Instead of with card, we have that extra cash in hand at the end of the month and tomorrow that extra cash is affording is a ďfreeĒ night out.

It becomes harder with play money as you buy things on Amazon with card or something like that, but in that case I just redeposit the money equivalent to that. In either case, you probably donít need my thought as you look to be going decent already!

BeaterGT

> Jake - Has Bad Luck So You Don't Have To

BeaterGT

> Jake - Has Bad Luck So You Don't Have To

01/31/2019 at 15:59 |

|

No debts? What kind of M ericaní you think you are?!

davesaddiction @ opposite-lock.com

> Jake - Has Bad Luck So You Don't Have To

davesaddiction @ opposite-lock.com

> Jake - Has Bad Luck So You Don't Have To

01/31/2019 at 16:13 |

|

Nice going!†

Jake - Has Bad Luck So You Don't Have To

> BeaterGT

Jake - Has Bad Luck So You Don't Have To

> BeaterGT

01/31/2019 at 16:19 |

|

I exclusively own Japanese cars and motorcycles.

Jake - Has Bad Luck So You Don't Have To

> UnderSTeerEnthusiast - Triumph Fanboy

Jake - Has Bad Luck So You Don't Have To

> UnderSTeerEnthusiast - Triumph Fanboy

01/31/2019 at 16:21 |

|

My first credit card was a Best Buy Visa I used to buy a Sony A6000 camera with last fall in order to build some credit. Now I have a Discover card that I use for everything and pay off twice per week using my phone. I have the app set up with fingerprint recognition on my phone and the whole nine yards with the intent of putting as few barriers as possible between me and hitting ďpay balanceĒ so I donít carry a balance forward and incur interest. It also has 1% cash back and 5% on groceries and gas.

Jake - Has Bad Luck So You Don't Have To

> CarsofFortLangley - Oppo Forever

Jake - Has Bad Luck So You Don't Have To

> CarsofFortLangley - Oppo Forever

01/31/2019 at 16:21 |

|

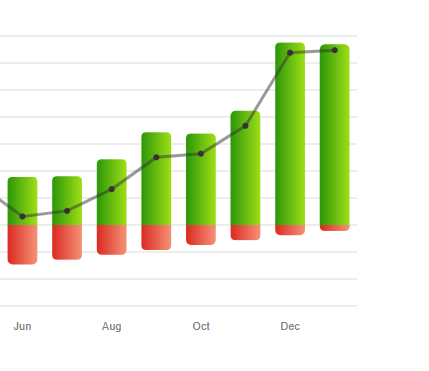

Red is debt, green is total liquid assets in all of my accounts.

BeaterGT

> Jake - Has Bad Luck So You Don't Have To

BeaterGT

> Jake - Has Bad Luck So You Don't Have To

01/31/2019 at 16:23 |

|

Good work, keep it up.† Only gets easier from here or so Iím told...

Yowen - not necessarily not spaghetti and meatballs

> Jake - Has Bad Luck So You Don't Have To

Yowen - not necessarily not spaghetti and meatballs

> Jake - Has Bad Luck So You Don't Have To

01/31/2019 at 16:31 |

|

Another great Discover card is the Miles card, contrary to its name, the points can be extracted from your account as cashback. It earns 1.5% on everything AND they double that at the end of your first 12 months with the card, so for its first year itís effectively a 3% back card. Iíve made this card my ďdaily driverĒ for anything that doesnít have 5% rotating cash back.

BeaterGT

> Jake - Has Bad Luck So You Don't Have To

BeaterGT

> Jake - Has Bad Luck So You Don't Have To

01/31/2019 at 16:32 |

|

Just remember to let the balance hit your statement before you pay it off or else youíre not building credit history, †youíre just being incredibly pro active. You have one full statement period before you incur interest on the balance that you donít pay down.

Yowen - not necessarily not spaghetti and meatballs

> Jake - Has Bad Luck So You Don't Have To

Yowen - not necessarily not spaghetti and meatballs

> Jake - Has Bad Luck So You Don't Have To

01/31/2019 at 16:45 |

|

So either you donít own a house or you worked REAL hard at paying it off, haha.

Jake - Has Bad Luck So You Don't Have To

> Yowen - not necessarily not spaghetti and meatballs

Jake - Has Bad Luck So You Don't Have To

> Yowen - not necessarily not spaghetti and meatballs

01/31/2019 at 17:04 |

|

Currently trying to get into a position to buy one.

Jake - Has Bad Luck So You Don't Have To

> BeaterGT

Jake - Has Bad Luck So You Don't Have To

> BeaterGT

01/31/2019 at 17:04 |

|

Yeah I leave a little behind

Mustafaluigi

> UnderSTeerEnthusiast - Triumph Fanboy

Mustafaluigi

> UnderSTeerEnthusiast - Triumph Fanboy

02/01/2019 at 08:52 |

|

But with that mindset you miss out on the 1-4% some cards give back to you along with building your credit. If you have the cash to buy something, use the card and pay immediately , even if its groceries. When you do this, just donít spend the cash and use the card at the same time. I never have cash on me, only use my credit card and my balance is paid off each month. I donít pay a dime in interest, I get percentages back in rewards and build my credit.

You donít need to pay off something over many months to build credit, but if you donít use it, there is no history of you paying ďdebtĒ for creditors to look at.

This is just as bad as the people I know who use only a debit card. If you can swipe the debit, you can swipe a credit card and pay it off at the end of the month, same thing but you get something out of it.

UnderSTeerEnthusiast - Triumph Fanboy

> Mustafaluigi

UnderSTeerEnthusiast - Triumph Fanboy

> Mustafaluigi

02/02/2019 at 01:13 |

|

I built my credit long ago. Now itís just adding age to my accounts. I still use cards but sparingly. 1-4% cash back, even on the purchases my cards have that apply, wouldnít be much back to me anyways. My finances are in good shape historically but I can say theyíve been much better since we started doing this. Iíve never carried a balance on a credit card and Iíve paid all my loans off early. Iím not saying cut out cards completely, but itís not hard to imagine that using cash more† would help control spending.

Mustafaluigi

> BeaterGT

Mustafaluigi

> BeaterGT

02/04/2019 at 07:30 |

|

Thatí s not totally true though. My wife pays her cards off multiple times a month, rarely letting anything hit a statement and her credit sits at 840-850.

BeaterGT

> Mustafaluigi

BeaterGT

> Mustafaluigi

02/04/2019 at 09:41 |

|

Yes, it is totally true and you should be proud of your wife. Iím talking about payments made in the same period as the initial purchase, not multiple payments against a balance after the statement closes. The former doesnít build credit history, the latter is business as usual.††

Mustafaluigi

> BeaterGT

Mustafaluigi

> BeaterGT

02/06/2019 at 14:43 |

|

Thatís what she does. She never carries a balance, every week shes paying it off to $0, effectively paying for what she just bought a few days prior. I do the same but just pay off the statement balance when due. Meaning neither of us accrue interest. Both of us have well over 800. The idea that you need to hold a balance to build credit is false.

Typically when you do this, the banks will start to offer you higher limits hoping to bait you in buying something larger with the new limit and thus needing to make multiple, interest accruing payments. Their goal is to make money but if you buy something with their money, and pay them off before its due, it doesnít make you a bad creditee , just a bad † revenue source.

BeaterGT

> Mustafaluigi

BeaterGT

> Mustafaluigi

02/06/2019 at 15:03 |

|

I guess I donít see the point of that since statements close monthly and y ou wouldnít accrue interest until those purchases hit your statement. Iím more in line with what you do, I pay off the statement balance once itís due . It doesnít make sense for me to charge my full car insurance premium , for example, to my credit card only to pay it off a few days later.

Definitely agree that you definitely donít need to hold a balance, I feel notions like that are just passed from generation to generation without the full understanding of debt and how it can work for/against you .† Had to explain this to a lot of my student loan carrying friends.

As for credit scores, p ersonally, I like using CreditKarma to get an overview of my report and score. I also find it funny you can request a larger credit limit to artifici ally inflate your score due to the debt utilization ratio . Shows how easy it is to poke holes in the score. † Donít know if you have looked into churning at all, but you seem financially savvy/secure †enough where it may be beneficial.

Mustafaluigi

> BeaterGT

Mustafaluigi

> BeaterGT

02/06/2019 at 16:23 |

|

She just hates having the debt over her head and then having a huge payment at the end of the month. Only difference with what she does and just paying cash like OP said is the miles/cash back getting accrued. Its why I get so heated when people say to never use CC and just pay cash, you loose out on so many benefits (rewards, credit score, freedom from having to go to the bank or ATM all the time for cash)

BeaterGT

> Mustafaluigi

BeaterGT

> Mustafaluigi

02/06/2019 at 16:35 |

|

Couldnít agree more, Iíve been flying almost free for the past seven years thanks to credit card bonuses.† I guess like anything else, there is a learning curve to it.